An online survey of German attendees at IFAT Munich examines the impact of the pandemic as well as the war in Ukraine on the environmental technology industry and looks at the opportunities associated with the European Green Deal and the circular economy. The world’s largest trade fair for environmental technologies will open its doors from May 30 to June 3.

“Technologies that advance environmental and climate protection are more sought after than ever. At the same time, both the effects of the pandemic and the war in Ukraine are a major challenge for the environmental sector. During IFAT Munich, the industry will have an in-depth exchange on these issues,” says Stefan Rummel, Managing Director of Messe München. Conducted in April by the independent market research institute IfaD, the online survey was answered by 943 IFAT Munich participants, both visitors and exhibitor representatives from the industry and water and waste management sectors.

Industry expands supplier base and inventories

As a result of the pandemic, the environmental industry primarily struggles with supply chain disruptions (according to 82 percent of respondents), operational constraints (69 percent) and difficulties in sales (58 percent). Consequently, problems with deliveries to customers (69 percent) and production downtimes (35 percent) lead to a loss of profit for 39 percent of those surveyed. To stabilize the situation, the industry mainly plans to expand its supplier base (44 percent) and increase inventories (44 percent).

The water and waste management sectors, which are locally focused, have been less affected by the pandemic and face primarily operational constraints (72 percent), followed by supply chain disruptions (64 percent). Expanding inventories is by far the top measure to counter the latter (34 percent).

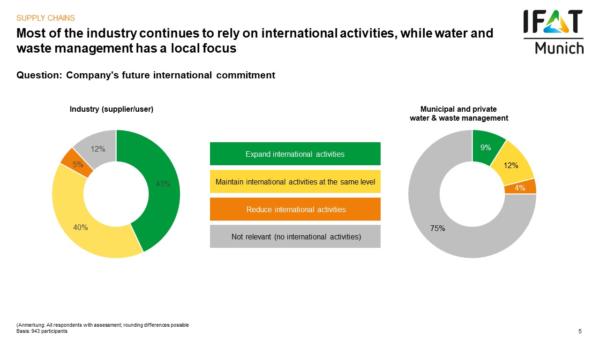

Environmental industry continues to think globally

The (environmental) industry will be even more international in the future: 43 percent of respondents indicated that their companies plan to expand international activities and 40 percent that they will continue at the same level.

War in Ukraine causes uncertainty

50 percent of respondents from the industry anticipate a strong impact on their business, compared to “only” 34 percent in the water and waste management sectors. According to almost 90 percent of all respondents, there is a risk that environmental and climate protection will be given lower political and public priority because of the war in Ukraine.

European Green Deal seen as an opportunity

The industry considers the European Green Deal a chance, 48 percent of the respondents see positive to very positive effects on their business. Although the water and waste management sectors were more reserved, 32 percent of them also expect the effects to be positive. In each case, one third of respondents did not dare to make a forecast.

Sector contributes to targets of the EU sustainable finance taxonomy

The European Union’s sustainable finance taxonomy aims to classify economic activities based on their sustainability. Most respondents have not yet looked into this issue. If they have done, particularly the industry sees an opportunity here as well (31 percent), while in water and waste management the figure is 18 percent. Both sectors strongly contribute to the taxonomy’s goals, especially pollution prevention (industry 57 percent, water and waste management 59 percent), climate protection (both 53 percent), the transition to a circular economy (47/44 percent) and the sustainable use of water resources (46/50 percent).

German government has yet to prove itself in circular economy

Cautiously positive: of those surveyed, half are not yet able or willing to comment on the plans for the German government’s National Circular Economy Strategy. The rest of the respondents, however, are largely optimistic, with a quarter considering the plans to be “extensive and ambitious”.

This is what needs to happen for a circular economy

According to the respondents, the top measures for a circular economy are longer product life (78/79 percent), improved recycling (77/64 percent), reduced material consumption (58/59), limited single use (56/60 percent). Rank 4: intelligent product design (39/32 percent). Rank 5: new business models (26/23 percent). 37 percent of the industry itself already offers circular products, as does a quarter of the wastewater and waste management sectors.